Setting financial goals is a crucial step in managing your finances effectively. Having a clear idea of what you want to achieve and when you want to achieve it will help you stay focused and motivated as you work towards your financial goals. Here are a few tips to help you set your financial goals:

- Determine your current financial situation: To set financial goals, you first need to understand your current financial situation. This includes determining your income, expenses, debts, and assets.

- Identify your short-term and long-term goals: Short-term financial goals are those that you want to achieve in the next one to three years, such as paying off credit card debt or saving for a down payment on a home. Long-term financial goals are those that you want to achieve in the next five years or more, such as saving for retirement or paying off your mortgage.

- Make your goals specific and measurable: Your financial goals should be specific and measurable, so that you can track your progress and make adjustments as needed. For example, instead of saying you want to “save more money,” specify that you want to save $5,000 in a year.

- Prioritize your goals: With limited resources, it may not be possible to achieve all your financial goals at once. Prioritizing your goals will help you focus your efforts and make the most of your resources.

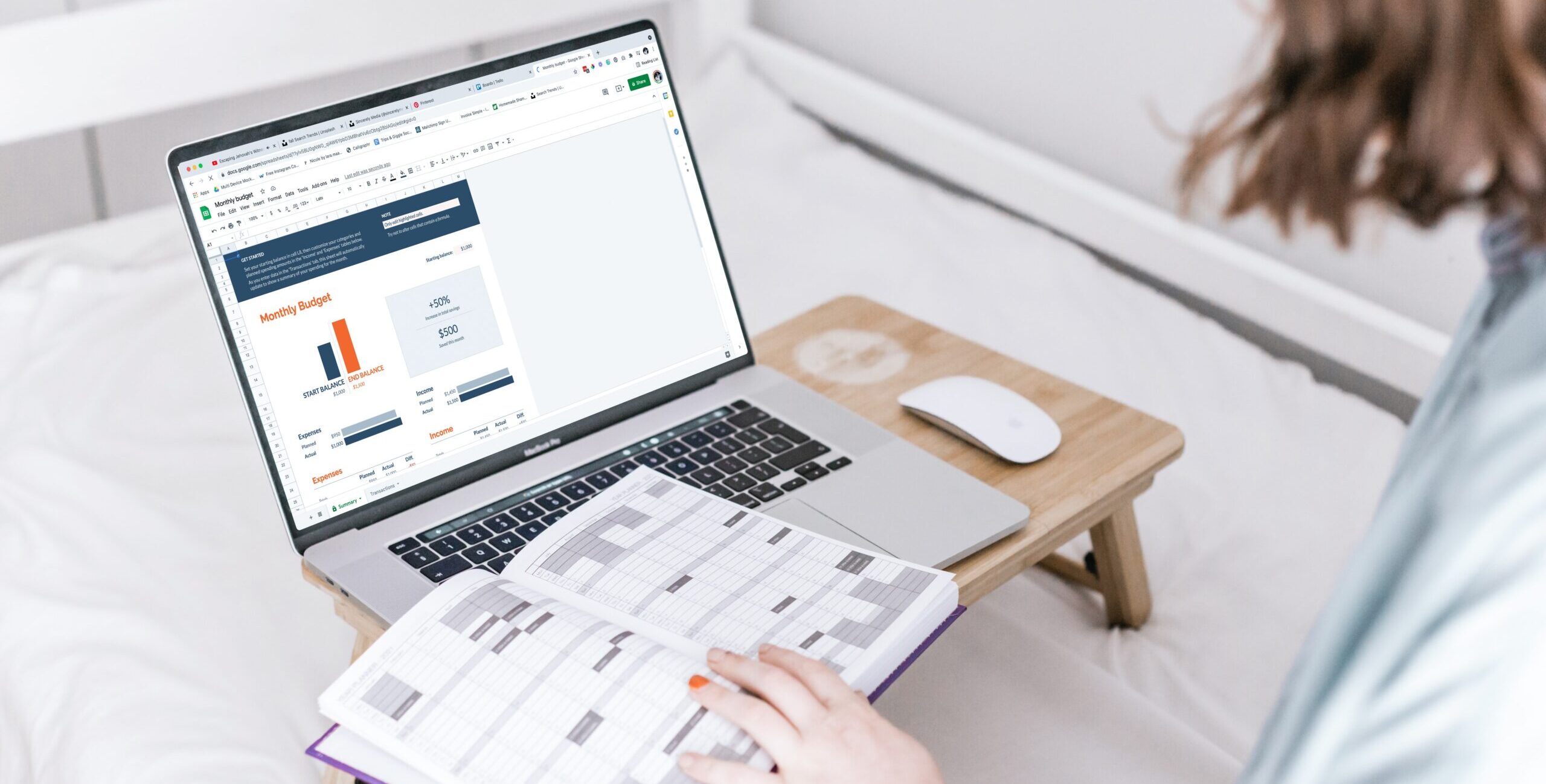

- Create a budget: A budget is a tool that can help you stay on track as you work towards your financial goals. It allows you to see where your money is going and make adjustments as needed to ensure that you’re allocating your resources in line with your goals.

- Review and adjust your goals regularly: As your circumstances change, you may need to adjust your financial goals. Reviewing your goals regularly will help you stay on track and make any necessary adjustments.

By following these steps, you can set achievable and realistic financial goals that will help you take control of your finances and achieve your desired financial outcomes.